Free Ucc 1 Louisiana Form

The UCC-1 form in Louisiana is a crucial document used in the realm of secured transactions, allowing creditors to establish their rights to collateral pledged by a debtor. This form plays a vital role in the financing process, providing a means to publicly record a security interest in personal property. It requires specific information, including the exact legal names of the debtor(s) and the secured party, ensuring clarity and precision in the identification of all parties involved. The UCC-1 form also necessitates details about the collateral, which can range from vehicles to equipment, and even fixtures associated with real property. Additionally, the form allows for the inclusion of multiple debtors and secured parties, accommodating various financial arrangements. Understanding the nuances of this form is essential for both lenders and borrowers, as it not only protects the interests of the secured party but also informs other potential creditors of existing claims against the debtor's assets. Filing this form correctly is paramount, as errors can lead to complications in the enforcement of security interests. In essence, the UCC-1 form serves as a foundational tool in commercial transactions, fostering transparency and security in the lending landscape.

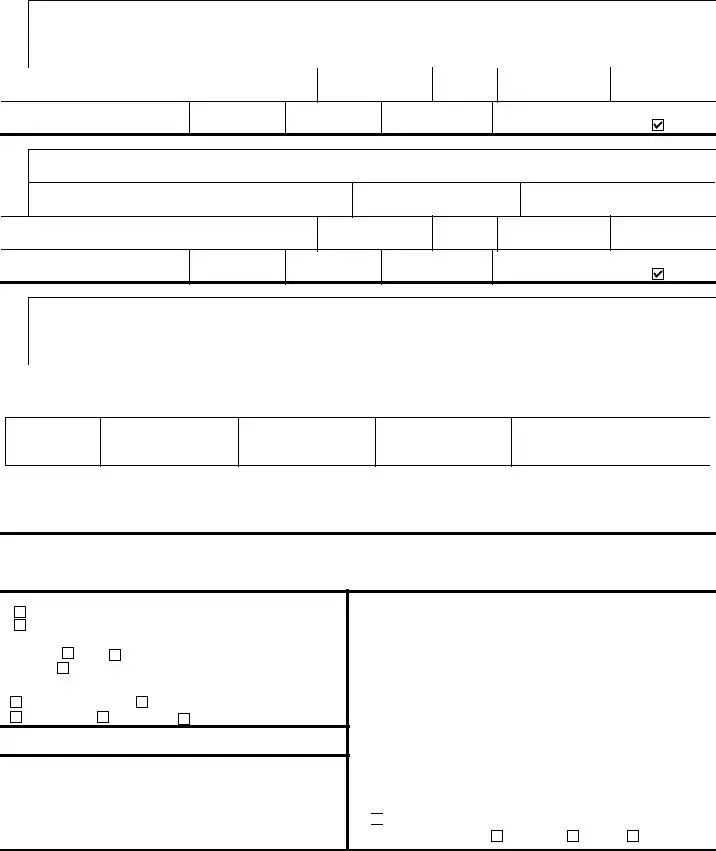

Sample - Ucc 1 Louisiana Form

STATE OF LOUISIANA

UNIFORM COMMERCIAL CODE - FINANCING STATEMENT -

IMPORTANT - Read Instructions on back before filling out form

1.DEBTOR'S EXACT FULL LEGAL NAME - insert only one debtor name (1a or 1b) - do not abbreviate or combine names 1a. ORGANIZATION'S NAME

OR |

1b, INDIVIDUAL'S LAST NAME (AND TITLE OF LINEAGE [e.g. Jr., Sr., III], if applicabl |

FIRST NAME |

MIDDLE NAME |

|

|||

|

JONES |

RON |

W |

|

|

|

|

|

|

|

|

1c. MAILING ADDRESS

1015 EAST BOBBY COURT

CITY

MILLERSVILLE

STATE

POSTAL CODE

37072-

COUNTRY

USA

1d. TAX ID #: SSN OR EIN

ADD'L INFO RE ORGANIZATION DEBTOR:

1e. TYPE OF ORGANIZATION

1f. JURISDICTION OF ORGANIZATION

1g. ORGANIZATIONAL ID #, if any

None

2.ADDITIONAL DEBTOR'S EXACT FULL LEGAL NAME - insert only one debtor name (2a or 1b) - do not abbreviate or combine names 2a. ORGANIZATION'S NAME

OR

2b, INDIVIDUAL'S LAST NAME (AND TITLE OF LINEAGE [e.g. Jr., Sr., III], if applicabl

FIRST NAME

MIDDLE NAME

2c. MAILING ADDRESS

CITY

STATE

POSTAL CODE

COUNTRY

USA

2d. TAX ID #: SSN OR EIN

ADD'L INFO RE ORGANIZATION DEBTOR:

2e. TYPE OF ORGANIZATION

2f. JURISDICTION OF ORGANIZATION

2g. ORGANIZATIONAL ID #, if any

None

3.SECURED PARTY'S NAME ( or NAME OF TOTAL ASSIGNEE OF ASSIGNOR S/P) - insert only one secured party name (3a or 3b) 3a. ORGANIZATION'S NAME

|

Alpha Omega Consulting Group, Inc. |

Fed ID# |

|

|

|

|

||

OR |

|

|

|

|

|

|

|

|

3b, INDIVIDUAL'S LAST NAME (AND TITLE OF LINEAGE [e.g. Jr., Sr., III], if applicabl |

FIRST NAME |

|

|

MIDDLE NAME |

|

|||

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

3c. MAILING ADDRESS |

|

CITY |

STATE |

POSTAL CODE |

COUNTRY |

|||

716 Vauxhall Drive |

|

Nashville |

TN |

37221 |

USA |

|||

|

|

|

|

|

|

|

|

|

4. This FINANCING STATEMENT covers the following collateral:

Year

1992

Color

blue

Make

buick

Model

century

Body Style |

VIN |

2d |

32132132132132112 |

|

|

5a. Check if applicable and attach legal description of real property: |

|

Fixture filing |

|

|

Standing tmbe |

|||

|

|

|

|

|

|

|

|

|

constituting goods |

|

The debtor(s) do not have an interest of record in the real property (Enter name of an owner of recor |

|

|

||||

|

|

|

|

|

|

|

|

|

5b. Owner of the property (if other than named debtor)

6a. Check only if applicabel and check only one box.

Debtor is a Transmitting Utility. Filing is Effective Until Terminat

Filed in connection with a public finance transaction. Filing is Effective for 30

6b. Check only if applicabel and check only one box. |

|

||||

Debtor is a |

Trust or |

Trustee acting with respect to property h |

|||

|

|

||||

in trust or |

Decedent's Estat |

|

|

|

|

|

|

||||

7. ALTERNATIVE DESIGNATION (if applicable): |

|

LESSEE/LESSOR |

|||

CONSIGNEE/CONSIGNOR |

BAILEE/BAILOR |

||||

SELLER/BUYER |

AG. LIEN |

|

|

||

|

|

|

|

|

|

8.Name Phone Number to contact filer

9.Send Acknowledgement To: (Name Address)

Alpha Omega Consulting Group, Inc.

Mike Burch

716 Vauxhall Drive

Nashville, TN 37221

(615)

10. The below space is for filing Office Use Only

11.

CHECK TO REQUEST SEARCH REPORTS ON DEBTOR(S

CHECK TO REQUEST SEARCH REPORTS ON DEBTOR(S

(ADDITIONAL FEE REQUIRED) |

ALL DEBTORS |

DEBTOR 1 |

DEBTOR 2 |

LOUISIANA APPROVED FORM

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The UCC-1 form in Louisiana is governed by the Louisiana Uniform Commercial Code, which is based on the national UCC framework. |

| Debtor Information | The form requires the exact full legal name of the debtor, with specific instructions to use either an organization’s name or an individual’s name without abbreviations. |

| Secured Party Details | The UCC-1 form mandates the inclusion of the secured party’s name and mailing address, ensuring clarity regarding the entity holding the security interest. |

| Collateral Description | Section 4 of the form requires a detailed description of the collateral, including specific identifiers such as the year, make, model, and VIN for vehicles. |

| Filing Requirements | The UCC-1 must be filed with the Louisiana Secretary of State to perfect a security interest, and it remains effective until terminated or a specific time frame elapses. |

More PDF Forms

La Oversize Permits - Includes a section for credit card information for those opting to pay the application fee via credit card.

Creating a comprehensive Last Will and Testament is essential for protecting your legacy and providing clear instructions for your loved ones. By specifying how your assets should be distributed and naming an executor to manage your estate, you can prevent potential disputes among family members. To help you navigate this important process, consider utilizing resources such as UsaLawDocs.com, which offers valuable guidance and templates for drafting your will effectively.

Road Tax for Commercial Vehicles - Enables carriers to comply with regulatory requirements for vehicle registration and operation in multiple states.