Free T 1B Louisiana Form

The T 1B Louisiana form is a crucial document for businesses involved in the timber industry, specifically when it comes to the payment of severance taxes. This form must be filed by entities that sever or purchase timber, ensuring compliance with Louisiana's tax regulations. It is essential for companies to accurately report their activities, as this form includes vital information such as the revenue account number, the name and address of the reporting company, and the taxable period. Additionally, it requires details about the plant or mill associated with the timber transactions. To avoid any penalties, timely submission is imperative; the form must be filed by the last day of the month following the month in which the timber was severed. If the deadline falls on a weekend or holiday, businesses should note that the return is due on the next business day. Furthermore, Schedule B of the form captures critical data about timber products that have been purchased or sold, including the names and addresses of the involved parties, their revenue account numbers, and the total tons of timber involved. Understanding the nuances of this form is essential for compliance and to ensure that all tax obligations are met efficiently.

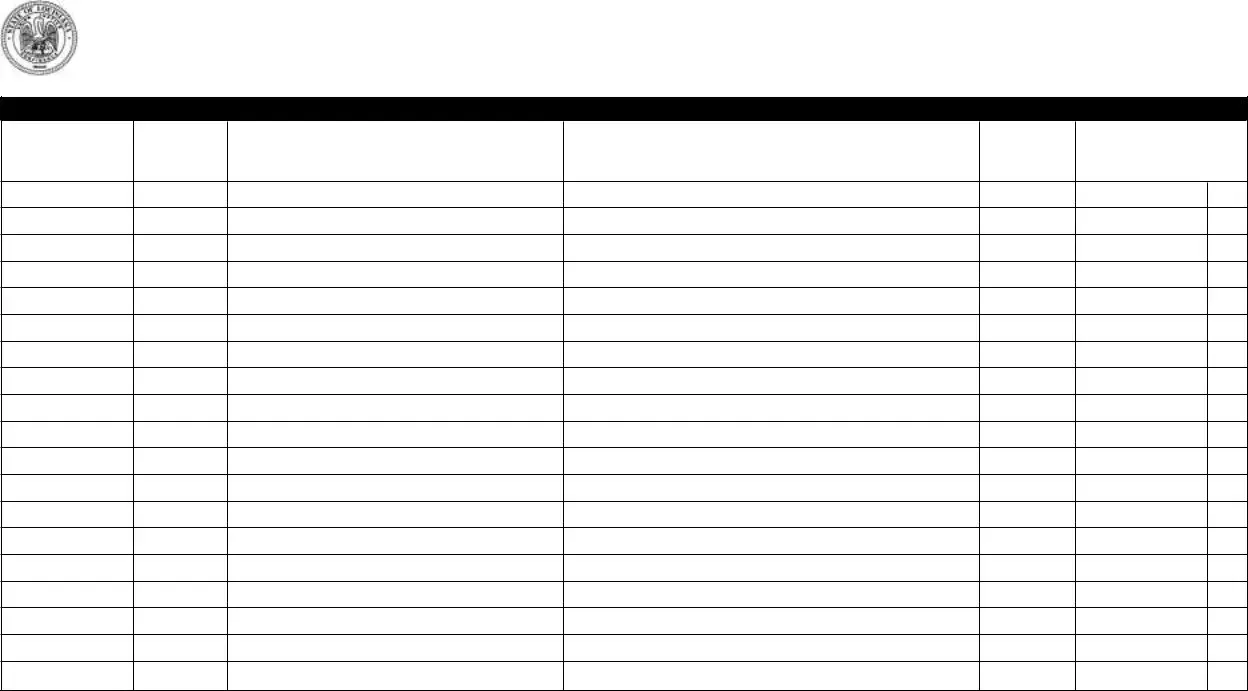

Sample - T 1B Louisiana Form

Form Sev. |

|

State of Louisiana |

|

|

Department of Revenue |

|

Timber Severance Tax |

|

P.O. Box 201, Baton Rouge, LA |

|

File original of this return only. |

Type or print complete name of reporting company |

Revenue Account Number |

|

|

Street address or rural route, city, state, ZIP |

Taxable Period |

|

|

Name of plant or mill for which this report is filed |

|

|

|

This form is to be completed when severance taxes are due by others on timber severed or purchased. In order to avoid penalties, this form must be filed on or before the last day of the month following the month in which the timber was severed. If the due date falls on a weekend or holiday, the return is due the next business day.

Schedule

Purchaser/ Seller

Revenue Account

Number

Seller=S

Purchaser=P

Name of seller/purchaser

Complete address of seller/purchaser

Parish |

Product |

code |

code |

|

|

Total Timber

tons

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Identification | The T 1B Louisiana form is officially titled "Timber Severance Tax" and is designated as Form Sev. T-1B R-9030-L. |

| Governing Law | This form is governed by Louisiana Revised Statutes Title 47, which addresses taxation in the state. |

| Purpose of the Form | The T 1B form is used to report severance taxes due on timber that has been severed or purchased by others. |

| Filing Deadline | To avoid penalties, the form must be filed by the last day of the month following the month in which the timber was severed. |

| Weekend/Holiday Rule | If the filing deadline falls on a weekend or holiday, the return is due on the next business day. |

| Schedule B Requirement | Schedule B must be completed to report timber products purchased or sold on which severance tax is owed. |

| Information Required | Key information includes the reporting company's name, revenue account number, and the name of the plant or mill. |

| Contact Information | All forms should be sent to the Louisiana Department of Revenue at P.O. Box 201, Baton Rouge, LA 70821-0201. |

More PDF Forms

Louisiana Credentialing Application - The application asks for a detailed schedule of office hours for each practice location to inform patients and credentialing bodies.

Creating a thorough Last Will and Testament is essential for anyone looking to secure their legacy and provide clarity for their loved ones after they pass. It not only specifies how assets will be distributed but also appoints an executor to manage the estate and ensure that all wishes are carried out as intended. For those looking to draft such a document, resources like UsaLawDocs.com can offer valuable guidance and forms to simplify the process.

La Unemployment Employer Login - With sections for employee details and wage totals, this form is integral to maintaining accurate payroll records in Louisiana.