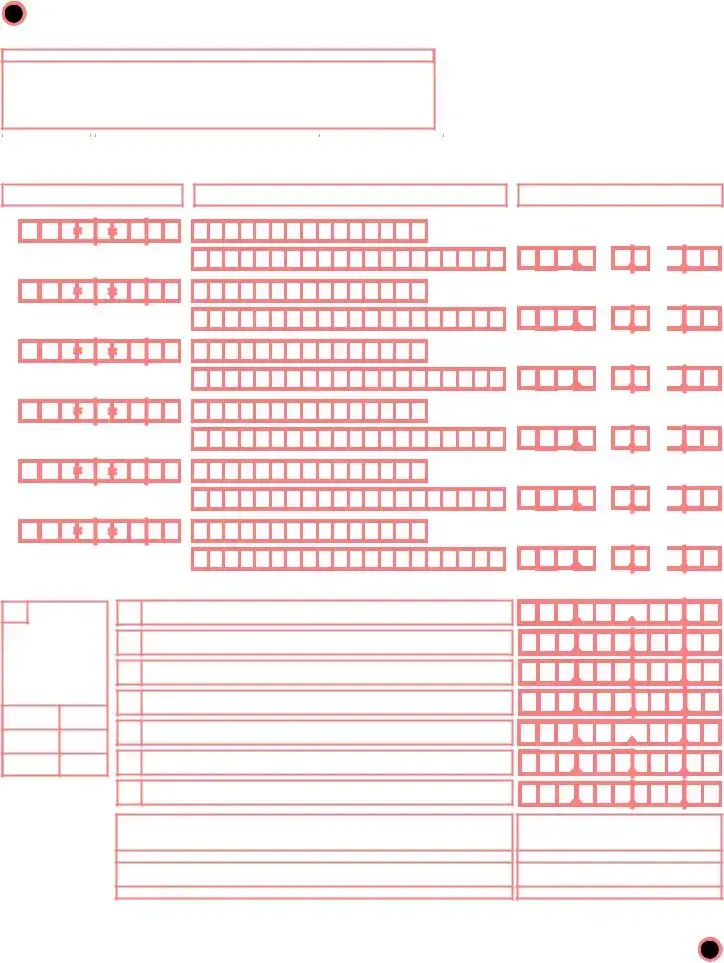

Free Louisiana Wage Report Form

The Louisiana Wage Report form is an essential document for employers in the state, designed to ensure accurate reporting of wages paid to employees. This form includes several key sections that employers must complete to comply with state regulations. It requires the employer's account number, the total wages paid, and the Social Security numbers of employees. Employers with 100 or more employees are required to file electronically, and it’s important to note that paper reports on disks are no longer accepted. Each report must be signed and dated by an authorized individual, confirming the accuracy of the information provided. Additionally, if an employer had no employment in any pay period, they must still file the report, indicating zero wages. The form also includes sections for reporting excess wages, which can affect tax contributions. Understanding how to fill out this form correctly is crucial for maintaining compliance and avoiding penalties.

Sample - Louisiana Wage Report Form

,>$$$

5,, |

|

6""& |

|

7!; |

|

8$#,& |

|

|

|

|

|

|

|

:#1#)!:)'

? "0 02/ %)>(78 >!47@8

'

9<= |

+ |

|

|

4 |

|

|

|

|

0 |

|

|

|

|

2 |

|

|

|

|

|

5

6

7

8

9

IMPORTANT: Reports on disks will no longer be accepted after Jan. 31, 2012. Employers reporting 100 or more employees MUST file electronically at www.laworks.net.

& 0*$

?A2A?$

"*$

2$ A2"2"$2

52 "22

# B

:2

5$ :2

6$ :2

#" 22

2

$ ""

7>0!*=

5 2%'

6 2+#"$02'

7 #(" 344$*$'

8 (&2+'

9 .,/,))!)/,,)01)!0)#

4

!"#"$#$% "&'

(=%$%

|

|

|

|||

|

|

|

|

||

|

|||||

|

|

||||

|

|

||||

|

|

||||

|

|||||

|

|||||

,

%2&

*004BC1101* *999999920101*

7>0 |

5 |

YEAR/QUARTER |

(PREPRINT) |

EMPLOYER ACCOUNT NUMBER |

(PREPRINT) |

!"#

/'. 0#1,)&*2)**3

+.' .

►Items 1, 2, 3, 4, 5 and 6 have been pre)printed on the report. IMPORTANT: Do not alter the preprinted information on this document. Changes must be reported on the Employer’s Report of Change Form, found at www.laworks.net.

►In Item 7, enter number of continuation sheets.

►In Items 8, 9 and 10, enter on lines 1 thru 6 the employee's social security number, the total wages paid (including tips), and the first and last name of each employee. Round to the nearest dollar amount. (up or down; I.E. $1081.49 shall be rounded to $1081.00 and $1081.50 shall be rounded to $1082.00). If you are reporting more than 6 employees, you will need a continuation sheet. If continuation sheets are needed go to www.laworks.net to download the Employer's Wage Report)Continuation Sheet.

Wage totals must be entered on each sheet; total wages this quarter, including continuation sheets, should be entered on line 13.

NOTE: In order to receive proper credit for the wages paid to your employees the social security numbers must be listed.

►In Item 11, enter the number of covered workers in each pay period including the 12th of each month (Do not include workers on strike).

►Total the wages entered for the employees on the front of this form and enter this amount in Item 12.

►In item 13, enter the total from Item 12 and the totals from each continuation sheet you have attached.

SIGNATURE: Each report must be signed and dated by the proprietor, officer of the corporation, partner or duly authorized individual. Please provide title and telephone number.

IF YOU HAD NO EMPLOYMENT IN ANY PAY PERIOD YOU MUST FILE THIS REPORT ENTERING ZERO ()0)) WAGES.

NOTE: THE WAGE BASE WAS $7000 PRIOR TO THE YEAR 2010.

►In Item 14, enter the total of all reported employees’ excess wages for the quarter.

The following is an example of an excess wage calculation based on a wage base of $7700.00. Jan Doe earned $3500 in the 1st quarter (Jan., Feb., Mar.). You will have )0) excess wages. Jan Doe earned $3000 in the 2nd quarter (Apr., May, June). You will have )0) excess wages. Jan Doe earned $3000 in the 3rd quarter (July, Aug., Sept.). You will have $1800 excess wages. Jan Doe earned $2500 in the 4th quarter (Oct., Nov., Dec.). You will have $2500 excess wages.

NOTE: EXCESS WAGES NEVER EXCEED TOTAL WAGES IN A QUARTER.

IMPORTANT: For your information only...(Effective Jan. 1, 1998)

To compute the total amount of the contributions you paid which may be reported on your FUTA 940 tax form.

Multiply this factor |

(REPRINT) |

times the tax due ___________ |

If you received a Notice of Tax Overpayment (Form T287ES) you may use any part of this credit toward your contributions due. Enter the amount of the overpayment you wish to use on line 17 of the Employer’s Quarterly Wage and Tax Report.

(NOTE : Overpayments equal to or less than $500 will be preprinted in this field. Underpayments equal to or less than $5 will be preprinted in this field.)

If you are filing after the due date for this quarter a portion of the interest and penalty due will be subtracted from the remittance. To calculate interest and penalty see the example below.

EXAMPLE: Assume the report is 15 days past the due date for the 1st quarter of 2000 (04/30/00).

The tax due = $350.00 and an underpayment of $2.50 is on the account. This brings the total due to $352.50. The interest calculation at 1% per month is 0.50% times the $352.50 tax due totaling $1.74.

The penalty calculation at 5% per month is of tax due + interest due , totals $17.71. The total payment equals $352.50 + 1.74 + 17.71 = $371.95.

Add the interest and penalty calculated to the tax due and enter on line 18 as total remittance.

QUESTIONS CAN BE DIRECTED TO: (PREPRINT) |

.___________________________________________ |

%1#4%556##%##56##4#78%9%6#%11

Form Characteristics

| Fact Name | Description |

|---|---|

| Filing Method | Employers with 100 or more employees must file electronically at www.laworks.net. |

| Preprinted Information | Items 1 through 6 on the report are preprinted and should not be altered. |

| Continuation Sheets | If reporting more than 6 employees, a continuation sheet is required for additional entries. |

| Social Security Numbers | Employee social security numbers must be included for accurate wage credit. |

| Zero Wages Reporting | If there were no employees in any pay period, a report must still be filed indicating zero wages. |

| Excess Wages | Excess wages reported cannot exceed total wages for the quarter. |

| Signature Requirement | The report must be signed and dated by an authorized individual, including their title and phone number. |

| Due Date | Reports must be submitted on time to avoid penalties and interest on late payments. |

| Governing Law | This form is governed by Louisiana state law regarding wage reporting and employer obligations. |

More PDF Forms

Medication Order Example - Mandates separate consent for the administration of medication, reinforcing the importance of legal guardian or parental approval.

For landlords looking to terminate a lease agreement effectively, the "key elements of a Notice to Quit" are crucial to understand. This form serves as an official notification, detailing the reasons for lease termination and the necessary timeline for tenants to vacate the property. Familiarizing oneself with this process is vital for ensuring compliance with legal requirements. For further guidance, refer to the key elements of a Notice to Quit.

Register Car in Louisiana - Body color, year, and mileage are key details that help identify your vehicle uniquely and accurately.