Free Louisiana R 6922 Form

The Louisiana R 6922 form is essential for partnerships operating within the state, as it facilitates the filing of a composite tax return. This form enables partnerships to report and pay taxes on behalf of both resident and nonresident partners. It requires specific information, including the partnership's name, address, and revenue account number, as well as the taxable periods for which the return is being filed. The form includes a summary section that outlines the total distributive shares for resident and nonresident partners, along with the corresponding taxes paid on their behalf. Additionally, it details the computation of any tax due, including potential interest and penalties. Accurate completion of the R 6922 form is crucial, as it involves declarations under penalties of perjury, ensuring that all information provided is true and complete. By adhering to the guidelines set forth in this form, partnerships can maintain compliance with Louisiana tax regulations and avoid potential issues with the Department of Revenue.

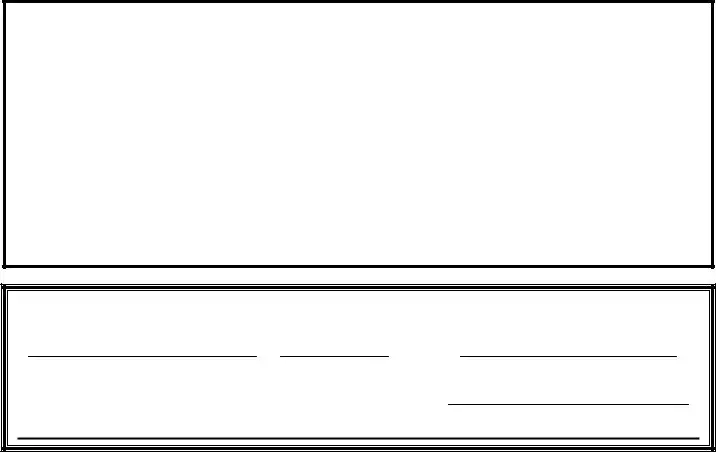

Sample - Louisiana R 6922 Form

State of Louisiana |

|

|

|

|

|||||

|

|

|

Department of Revenue |

|

|

|

|

||

|

|

|

Louisiana Composite Partnership Return |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

Partnership name, address and ZIP |

|

|

|

|

|

||

|

|

|

|

|

Revenue account number |

____________________________ |

|||

|

|

|

|

|

Taxable period beginning |

___________ |

_______ |

_______ |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

Month |

Day |

Year |

|

|

|

|

|

Taxable period ended |

___________ |

_______ |

_______ |

|

|

|

|

|

|

|

|

Month |

Day |

Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Summary of tax paid on behalf of partners |

|

|

|

|

||

1) |

Total distributive share for RESIDENT partners included |

|

|

|

|

||||

|

|

with the Louisiana Composite Partnership Return |

____________________ |

|

|||||

2) |

Total Louisiana Composite Return tax paid on behalf of qualified |

|

|

|

|

||||

|

|

RESIDENT partners |

|

|

|

____________________ |

|

||

3) |

Total distributive share for NONRESIDENT partners included |

|

|

|

|

||||

|

|

with the Louisiana Composite Partnership Return |

____________________ |

|

|||||

4) |

Total Louisiana Composite Return tax paid on behalf of qualified |

|

|

|

|

||||

|

|

NONRESIDENT partners |

|

|

|

____________________ |

|

||

5) |

Total tax paid (add Lines 2 and 4) |

____________________ |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

Computation of amount due |

|

6) |

Tax due (Line 5 above) |

|

____________________ |

7) |

Interest – see instructions |

____________________ |

|

8) |

Penalty – see instructions |

____________________ |

|

9) |

Amount due (add Lines 6, 7 and 8 above) |

____________________ |

|

|

Make payment to: |

Louisiana Department of Revenue |

|

|

|

P.O Box 4998 |

|

|

|

Baton Rouge, LA 70821 – 4998 |

|

Do not send cash.

Under penalties of perjury, I declare that I have examined this return including all accompanying documents, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of paid preparer is based on all available information.

Signature |

Date |

Signature of paid preparer other than taxpayer |

Social Security Number, PTIN, or FEIN of paid preparer

State of Louisiana

Department of Revenue

Louisiana Resident Composite Tax Return Schedule

Partnership name ____________________________ |

Page _____ of _____ |

Revenue account number______________________ |

|

Partner Number

Name and address of partner

Partner ID

number

Distributable

share

Total distributive share for resident partners included with the Louisiana Composite Return…………………

Total LA Composite Return Tax paid on behalf of qualified resident partners included with the LA Composite Return…..

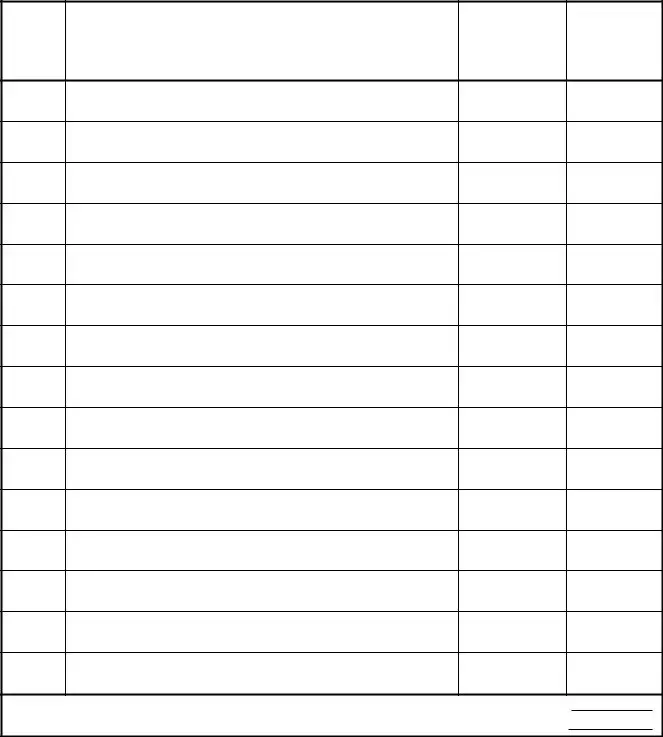

State of Louisiana

Department of Revenue

Louisiana Nonresident Composite Tax Return Schedule

Partnership name ____________________________ |

|

Page ____ of ____ |

|||||||

Revenue account number______________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non- |

|

|

|

Partner |

Name and address of partner |

Partner ID |

Distributable |

|

|

resident |

Included in |

||

Number |

number |

share |

|

|

partner |

Composite |

|||

|

|

agreement |

Return |

||||||

|

|

|

|

|

|||||

|

|

|

|

|

|

filed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total distributive share for nonresident partners included with the Louisiana Composite Return………………. |

|

|

|

|

|

||||

Total LA Composite Return Tax paid on behalf of qualified nonresident partners included with the LA Composite Return…. |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The Louisiana R 6922 form is used for filing the Louisiana Composite Partnership Return. |

| Governing Law | This form is governed by Louisiana Revised Statutes Title 47, specifically related to partnership taxation. |

| Taxable Period | The form requires the taxpayer to specify the beginning and ending dates of the taxable period. |

| Resident Partners | It includes sections for reporting the total distributive shares and taxes paid on behalf of qualified resident partners. |

| Nonresident Partners | There are dedicated sections for nonresident partners, detailing their distributive shares and taxes paid. |

| Payment Instructions | Payments must be made to the Louisiana Department of Revenue and should not be sent in cash. |

| Declaration Requirement | Taxpayers must declare that the information provided is true and complete, under penalties of perjury. |

| Interest and Penalty | Taxpayers are responsible for calculating any interest and penalties as instructed on the form. |

| Signature Requirement | The form must be signed by the taxpayer and, if applicable, by the paid preparer. |

More PDF Forms

Louisiana Dept of Education - By documenting incidents of serious wrongdoing, such as assault, theft, or drug use, the form plays a crucial role in the school's safety and disciplinary protocols.

Understanding the importance of a Last Will and Testament form is essential for anyone looking to secure their assets and provide clarity to their loved ones after their passing; resources such as UsaLawDocs.com offer guidance on how to correctly create this vital document to ensure that one's final wishes are respected.

Cash Sale Deed Louisiana - The conventional process in Louisiana for buying land with a one-time cash payment.