Free Louisiana 1029 Sales Form

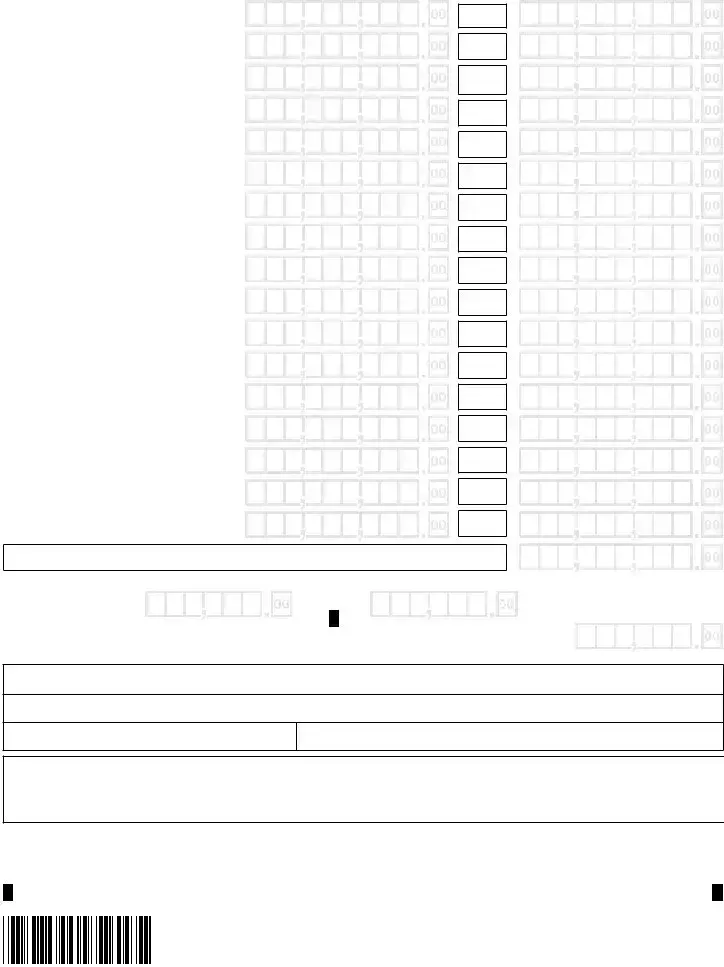

The Louisiana 1029 Sales form is a crucial document for businesses operating within the state, specifically designed for reporting sales tax. This form is applicable for filing periods starting from August 2020 and is used to calculate the total sales tax owed to the Louisiana Department of Revenue. It requires businesses to report gross sales of tangible personal property, as well as income from leases, rentals, and services, excluding motor vehicle transactions. The form includes sections for allowable deductions, which encompass various exemptions such as sales to government entities and certain utilities. Additionally, businesses must calculate the tax due based on taxable amounts, and they can also report any excess tax collected. The Louisiana 1029 Sales form emphasizes accuracy, requiring filers to round amounts to the nearest dollar and to use specific ink colors. Vendors can claim compensation for timely submissions, and there are provisions for donations to military assistance funds. Completing this form accurately is essential for compliance and avoiding penalties.

Sample - Louisiana 1029 Sales Form

FOR OFFICE USE ONLY. Field flag

|

|

|

Louisiana Department of Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

Sales Tax Return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Location address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

CITY |

|

|

STATE |

|

|

|

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ACCOUNT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LEGAL NAME |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do not use this form |

|

|

|

|

|

|

|

TRADE NAME |

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

for filing periods |

prior |

|

|

|

|

|

|

|

MAILING ADDRESS |

UNIT TYPE |

UNIT NUMBER |

||||||||||||||||||

|

|

|

|

to July 2022. |

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

STATE |

|

|

|

ZIP |

|||||

|

|

|

|

Filing period |

|

|

M |

M |

Y |

Y |

|

|

|

|

FOREIGN NATION, IF NOT UNITED STATES (DO NOT ABBREIVATE) |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please use blue or black ink. |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

U.S. NAICS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Round to the nearest dollar. Do not use dashes. |

|||||||||||||

1 |

|

Gross sales of tangible personal property |

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

2 |

|

Cost of tangible personal property |

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

(Used, consumed, or stored for use or consumption in Louisiana.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

3 |

|

(a) Leases and rentals of tangible personal property |

|

|

|

|

3(a) |

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

(Do not include motor vehicle leases or rentals, which must be filed electronically. |

See instructions.) |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

(b) Taxable services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3(b) |

|

|

|

|

|

|

|

|

|

|||||||

3 |

|

Total leases, rentals, and taxable services (Add Lines 3(a) and 3(b).) |

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

4 |

|

Total (Add Lines 1, 2, and 3.) |

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

5 |

|

Total allowable deductions (From Line 32, Schedule A. Do not |

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

include as a deduction any item not reported on either Line 1, 2, or 3.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

6 |

|

Amount taxable (Subtract Line 5 from Line 4.) |

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

7 |

|

Tax due (Multiply amount on Line 6 by 4.45%.) |

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

8 |

|

Excess tax collected (Do not include local sales tax.) |

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

9 |

|

Total (Add Line 7 and Line 8.) |

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

10 |

Vendor’s compensation 0.944% (0.944% of Line 9 if not delinquent. Limited to $1500. The |

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

0.944% rate is the equivalent of 4 cents out of 4.45 cents of the 1.05% V.C. rate. See instructions.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

11 |

Net tax due (Subtract Line 10 from Line 9.) |

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

11 |

(a) Donation to The Louisiana Military Family Assistance Fund |

|

|

|

11(a) |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

(Enter the amount from Line 33 from the back of the return.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

12 |

Penalty (See instructions.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

13 |

Interest (See instructions.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

14 |

Total payment due (Add Lines 11, 11(a), 12, and 13.) |

|

|

Mark this box if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

payment made |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

Make payment to: Louisiana Department of Revenue. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

electronically. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

WEB |

PAY THIS AMOUNT (DO NOT SEND CASH.) u |

14 |

|

|

Each physical location must register to

obtain a separate Revenue Account ID. |

|

|

|

|

Taxpayer’s FEIN |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Final |

|

|

|

Enter date |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

business |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

sold/terminated. |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Parent Company FEIN

If amended return, |

42273 |

|

mark this box. |

||

|

Allowable Deductions – Schedule A |

Total Sales |

|||

|

||||

|

|

|

|

|

15 |

Intrastate telecommunication services |

|

|

|

|

(Do not include prepaid telephone cards.) |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

16 |

Interstate telecommunication services |

|

||

|

|

|

|

|

|

|

|

|

|

17 |

Prepaid telephone cards |

|

||

|

|

|

|

|

|

|

|

|

|

18 |

Electricity and natural gas or energy for non- |

|

||

|

residential use |

|

||

|

|

|

|

|

|

|

|

|

|

19 |

Steam and bulk or utility water used for non- |

|

||

|

residential purposes |

|

||

|

|

|

|

|

|

|

|

|

|

20 |

Boiler fuel for nonresidential use |

|

||

|

(See instructions.) |

|

||

|

|

|

|

|

|

|

|

|

|

21 |

Sales/purchase/leases/rentals of manufactur- |

|

||

|

ing machinery or equipment |

|

||

|

|

|

|

|

22 |

Sales to U. S. government and Louisiana |

|

||

|

state and local government agencies |

|

||

|

|

|

|

|

|

|

|

|

|

23 |

Sales of prescription drugs |

|

||

|

|

|

|

|

|

|

|

|

|

24 |

Sales of food for home consumption |

|

||

|

|

|

|

|

|

|

|

|

|

25 |

Electricity, natural gas, and bulk water for |

|

||

|

residential use |

|

||

|

|

|

|

|

|

|

|

|

|

26 |

Sales in interstate commerce |

|

||

|

|

|

|

|

|

|

|

|

|

27 |

Sales for resale |

|

||

|

|

|

|

|

|

|

|

|

|

28 |

Cash discounts, sales returns and |

|

||

|

allowances |

|

||

|

|

|

|

|

29 |

Tangible personal property sold for lease or |

|

||

|

rental (See instructions.) |

|

||

|

|

|

|

|

|

|

|

|

|

30 |

Sales of gasoline, diesel, and motor fuel |

|

||

|

(Sales for resale must be reported on Line 27.) |

|

||

|

|

|

|

|

31 |

Total from SCHEDULE |

|

||

|

(Transactions taxed at 0%.) |

|

||

|

|

|

|

|

Percent Exempt

22.472%

44.944%

22.472%

55.056%

55.056%

55.056%

100%

100%

100%

100%

100%

100%

100%

100%

100%

100%

100%

32 Add Lines 15 through 31; enter here and on Line 5.

33(a) Donation of Vendor’s Compensation |

33(b) Donation in Addition to Tax Due |

|

The Military Family |

|

|

Assistance Fund |

|

|

Worksheet |

|

|

33 Total Donation (Add Lines 33(a) and 33(b)) Enter here and on Line 11(a) on front of return |

33 |

|

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Signature

Print Name

|

Date (mm/dd/yyyy) |

Title |

Telephone |

|

|

PAID

PREPARER USE ONLY

Print Preparer’s Name |

Preparer’s Signature |

Date (mm/dd/yyyy) |

Check if |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s Name ➤ |

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s EIN ➤ |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s Address ➤ |

|

|

|

|

|

|

|

|

|

|

|

|

Telephone ➤ |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PTIN, FEIN, or LDR account |

For Office |

number of paid preparer |

Use Only. |

Louisiana Department of Revenue Post Office Box 3138 |

Baton Rouge, LA |

This return is due on or before the 20th day following the taxable period covered and becomes delinquent on |

42274 |

|

the first day thereafter. If the |

due date falls on a weekend or holiday, the return is due the next business day and |

|

becomes delinquent the first |

day thereafter. |

|

|

|

|

Enter your Louisiana Revenue Account Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

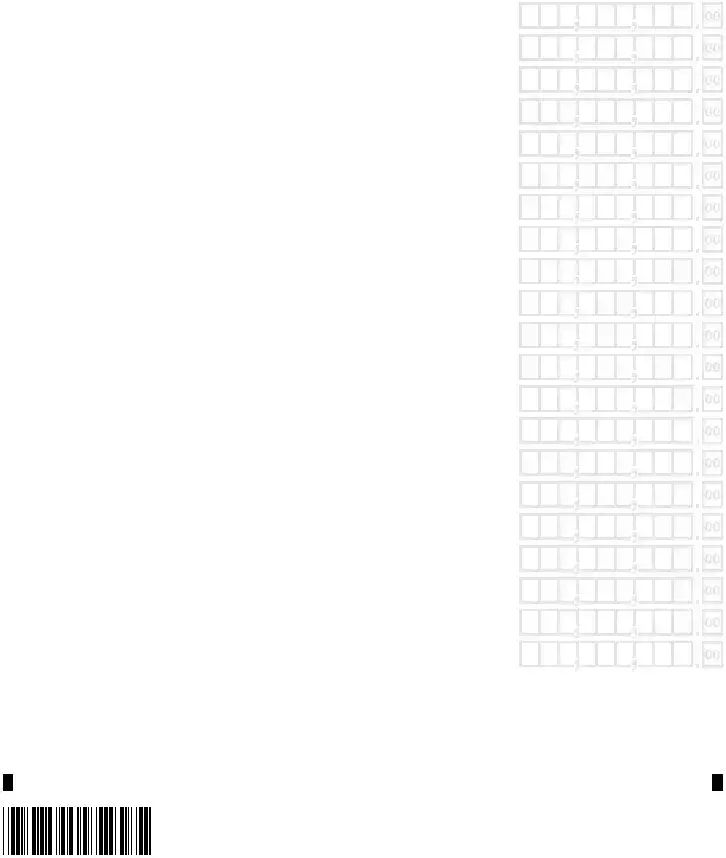

Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description |

|

|

|

Sales Tax |

|

|

|

Total Sales |

|

|

||||||||||||

|

|

Exemption Code |

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

21 |

Add Lines 1 - 20; enter here and on Line 31 of Schedule A, under the Total Sales column. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

42275

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The Louisiana 1029 Sales form is used for filing sales tax returns in Louisiana. |

| Effective Date | This form is applicable only for filing periods starting from August 2020. |

| Filing Frequency | Returns must be filed on or before the 20th day following the taxable period. |

| Tax Rate | The sales tax rate applied is 4.45% on the taxable amount. |

| Vendor's Compensation | Vendors can receive compensation of 0.944% of total tax collected, capped at $1,500. |

| Allowable Deductions | Certain deductions are allowed, such as sales to government agencies and food for home consumption. |

| Payment Methods | Payments can be made electronically; cash payments are not accepted. |

| Amended Returns | If you need to amend a return, there is a specific checkbox to indicate this on the form. |

| Penalties and Interest | Penalties and interest may apply for late submissions; refer to the instructions for details. |

| Governing Law | The form is governed by Louisiana sales tax laws, specifically under the Louisiana Department of Revenue regulations. |

More PDF Forms

Louisiana Disciplinary Board - This form is for lawyers wanting to work in Louisiana courts for a specific case without being members of the Louisiana Bar.

Creating a comprehensive Last Will and Testament form is essential for anyone looking to secure their legacy and ensure that their wishes are followed after their passing. This legal document not only outlines the distribution of assets but also appoints an executor responsible for managing the estate. To simplify the process, you can find a customizable template at UsaLawDocs.com, making it easier to create a valid and effective will that reflects your desires and protects your loved ones from potential disputes.

Louisiana Resale Certificate - Supports the economic ecosystem in Louisiana by allowing resellers to purchase goods without incurring sales tax.